ROLE:

PRODUCT DESIGNER

CLIENT:

BANYAN SECURITY

TEAM:

PRODUCT

Reducing card spend

by 40k annually

Synopsis.

Our card program was incurring additional costs due to physical card delivery problems + lack of physical card usage for users.

I led product design for a multi-phase deliverable. I partnered closely with our head of product, engineering leadership and our card team to audit, refine ux, and replace with new design system.

Project Context.

Company / Product:

Tapcheck Mastercard

Timeline & Team:

4 sprints, 2 FE, 2 BE, PM, Designer

My Role:

Led research, ideation, wireframing, prototyping, hifi and iteration to production.

Problem & Goals.

Business problem:

Spending on physical cards has greatly increased, putting our card program at risk. We need to reduce physical card spending.

User problem:

Users are not receiving their cards, users lack strong usage of physical cards outside of ATM.

Success Metrics:

• Reduce card program costs by $40K annually.

• Increase delivery success rate by 10%

• Reduce CS tickets related to card issues.

Insights we're solving for.

Many users aren't receiving their physical card in the mail. In today's flow we ask for users address at main registration flow for the app, but don't confirm address pre-shipment of card.

Some users in multi-unit buildings weren't receiving cards. Many user's entered the correct address, but didn't receive their card because of apartment / suite errors.

64% users only use virtual card with digital wallet. We actually don't need to ship the card unless the user actually wants the card. (currently we autoship the physical card)

User insight themes.

Many cards aren't being delivered, or delivery was taking a prolonged period of time.

User's intend to use card as destination account -> then to purchase or send to family / friends with other apps

User's who preferred cash (ATM's) wanted a physical card

Users expect physical cards based on history of card process, seeing in mail.

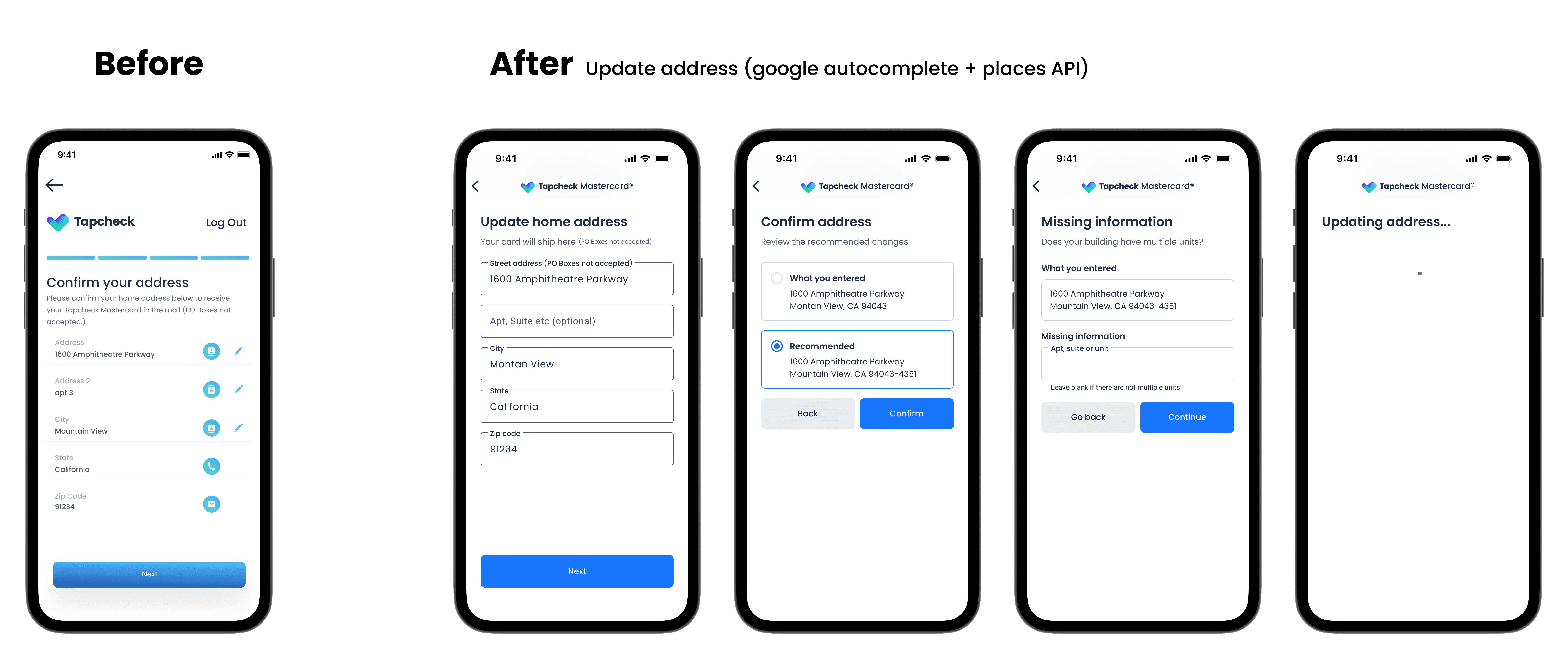

How can we make card deliveries more successful?

In comparing our 2 funnels for card registration we found a problem with confirming addresses. If a user registers for the card after signing up for earned wage access in our main registration flow and later sign up for the card, they aren’t prompted to confirm address again.

By adding a confirm / update address upon card request, we can greatly increase our delivery success by closing down the time gap between registration and request.

How might we make multi-unit building deliveries more efficient?

We added address validation via google places API / google autocomplete api. This is a high impact / low effort way to increase delivery success as it was previously built.

Do users definitely need a physical card?

Through amplitude, we found that only 44% of our users were using the physical card. Given that lower percentage, we wanted to experiment with a virtual first approach that allows users to request a card (instead of auto shipping upon registration success). This will automatically reduce our physical card costs.

While we want the users feel comfort that they can have a card if they need one, we also want to find a balance of only sending to cards users that would actually use them.

We also want users to feel excitement that they're receiving a card if they request one.

Responsive web versions

We applied our design system to responsive web versions from existing containers for seamless translation.

Demo - Reduce plastic flow

How a user confirms their address, receives their virtual card, and requests a physical card if they choose to.

Our impact & what we learned

18% increased delivery success

Integrating Google Places API for address input led to an 18% increase in successful deliveries for requested cards by reducing formatting errors and improving address accuracy at the point of entry.

Business impact

40k projected annual savings on physical cards due to ux changes.

Virtual card first experience delivers

By prioritizing a virtual card–first experience to streamline activation and reduce logistical overhead. By targeting engaged users and surfacing the virtual card earlier in the flow, we saw a sustained month-over-month decline in physical card requests, indicating higher adoption of the card-first model and improved alignment with actual usage patterns.